We all know the “local mortgage expert.” That neighbour who always seems to have an opinion about what you should be doing with your mortgage. The problem is, those who know the least about a subject often speak the loudest, and mortgages are no exception.

When it comes to mortgages, it is important to understand that there is a good chance not everything you have heard is true. To help clear up some of the misguided advice that circulates, here is a list of the top mortgage myths you may encounter in Canada, along with the truth that dispels them.

In this article:

- Myth #1 – The Mysterious Downpayment Rules

- Myth #2 – It Always Makes Sense to Take the Lowest Interest Rate

- Myth #3 – Lenders Want You to Have No Debt

- Myth #4 – Going to Your Bank is the Best Place to Get Your Mortgage

- Conclusion

Myth #1 – The Mysterious Downpayment Rules

You will hear all kinds of things about how much of a downpayment you need and how you can get said downpayment. The myths that you may have heard could include:

In order to purchase a home, you need to have 20% of the purchase price available as a downpayment.

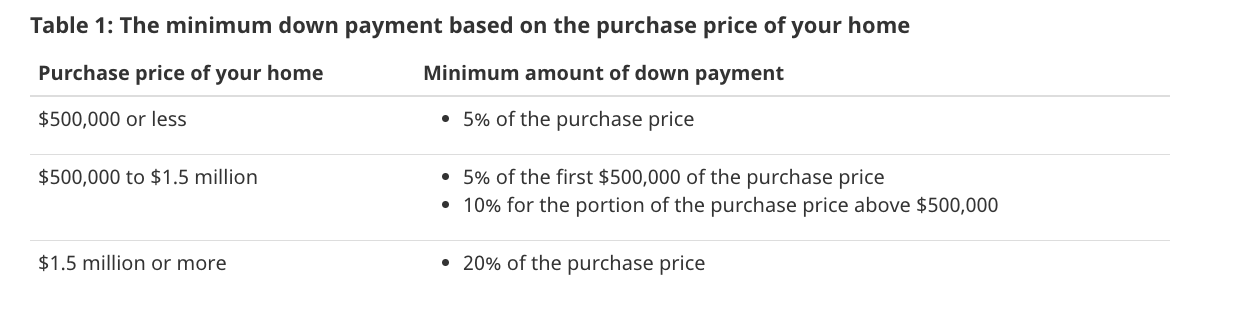

This simply isn’t true. While a 20% downpayment does have a significance in the Canadian mortgage landscape, it isn’t a requirement unless you are buying a home with a purchase price of more than $1.5 Million. From the Government of Canada’s website, the down payment rules are as follows:

If you are making a down payment of less than 20%, you will need to pay a premium for mortgage default insurance from the lender. Typically, this is provided by the Canada Mortgage and Housing Corporation (CMHC), Sagen, or Canada Guaranty Mortgage Insurance Company.

You are not allowed to borrow or be gifted any of your down payment.

While this may have been true years ago, the reality in today’s housing market is that for many first time buyers, home ownership simply wouldn’t be an option if they weren’t allowed to borrow money for a down payment.

Specifically, we’re seeing many situations where people are being ‘gifted’ money from parents or grandparents to help with the purchase of their home. In this circumstance, lenders like to see letters indicating that the funds are a gift and repayment is not required.

You are also able to borrow funds for a down payment in the form of personal loans, lines of credit or even a credit card as long as the funds are from a source that is not tied to the purchase of the property. If you do this, remember, the borrowed funds will count in the calculation of your mortgage affordability.

Myth #2 – It Always Makes Sense to Take the Lowest Interest Rate

On the surface this would definitely seem like a no-brainer; of course you should take the lowest interest rate! On such a significant debt, a fraction of a percentage point can mean a significant difference in your payment over the term of the mortgage. That said, not all mortgages are created equal. It’s important that you understand that the lowest rate offered doesn’t necessarily mean that the mortgage is the best one to go with. Instead, you need to see what the mortgage has in terms of other options attached to it. For example:

What prepayment options are included?

These options can make a big difference given the way that mortgage interest is calculated and the way you can pay off a mortgage faster. Prepayments apply directly to the principle of the mortgage and can save you thousands of dollars in interest charges. If your mortgage offers a low interest rate but bad prepayment options, it could actually end up costing you more.

How is the penalty calculated if you break the mortgage?

With the unpredictability of life, there are many reasons that you may need to break your mortgage early. In this case, you will need to understand how the penalty is calculated. In situations where the penalty is calculated using the Interest Rate Differential (IRD) method, breaking the mortgage can end up costing you thousands of dollars. This is one of the many other options to consider when choosing the right mortgage. In the long run, paying a slightly higher interest rate to have options outside of IRD to calculate the cost of breaking your mortgage can end up saving you a lot of money.

How portable is your mortgage?

If there’s a chance that you will move during the term of your mortgage, you are much better off to have a mortgage that provides good portability options. A portable mortgage allows you to transfer the mortgage you currently hold to a new property without paying any penalties or going through the qualification process again. Many low rate mortgages aren’t portable so, if you choose based solely on the lowest interest rate, you could be faced with an expensive penalty to break the mortgage that ends up costing a significant amount of money.

Myth #3 – Lenders Want You to Have No Debt

Not carrying debt does not necessarily mean you will be more easily approved for a mortgage. Lenders look at several factors, and you need to meet requirements across all of them in order to ensure a smooth approval process.

- Your debt service ratio needs to be in good standing. This ratio compares your income to the amount of debt you are required to make monthly payments on. If your ratio shows that too much of your income would be going towards paying off debt, getting a mortgage will be difficult.

- Your credit score needs to be in good standing. This is one area where having no debt can actually work against you. Lenders want to see a strong credit history that demonstrates your ability to manage and repay debt responsibly. Without a proven track record of making payments, applying for and securing a mortgage can be much more difficult.

If you have never had any debt, it can actually work against you. Building a history of using credit wisely helps establish a strong credit score, and when combined with a stable income that supports your debt payments, it makes qualifying for a mortgage much easier.

Myth #4 – Going to Your Bank is the Best Place to Get Your Mortgage

This is truly one of the worst myths out there. Let’s consider another example outside of mortgages. When you need car insurance, are you better off going to an agency owned by a single insurer, which only offers one option, or to a brokerage that has access to many different providers, can shop the market for you, and ensure you get the best coverage for your needs?

I know, this might sound like a “leading the witness” moment on Law and Order, but it is still a valid point. If you go directly to one of the big banks, they will only offer you their own mortgage products. The day I meet someone who goes to TD Bank, for example, and is told by their advisor that the best product for them is with RBC, will be the first day I hear of that happening.

A mortgage broker, on the other hand, can search the entire Canadian mortgage market on your behalf. In fact, many mortgage brokers can still place you with one of the big banks if that turns out to be the best option. But if you only go to the bank in the first place, how would you know whether their product is truly the best fit for you, or simply the only one they have to offer?

If you are looking for a great team of mortgage brokers who can shop the market and find the right solution for your needs, reach out to Strata Mortgages. They will provide you with a solution that is tailored to your personal financial situation.

Conclusion

When it comes to mortgage myths in Canada, it is important to separate fact from fiction so you can make the right decision about one of the biggest financial commitments of your life. Believing misinformation can create unnecessary stress, cause you to miss valuable opportunities, and lead to costly mistakes.

If someone tells you that you need 20% for a down payment, that the lowest rate is always the best option, or that you should only go to your bank for a mortgage, you now know these are myths that can end up costing you money. The Canadian mortgage landscape is more flexible and nuanced than many people realize.

To navigate it with confidence, connect with Strata Mortgages today. The mortgage product everyone is talking about may not be the right one for you. The team at Strata Mortgages will work with you to find the solution that truly fits your life, and that is what matters most.