As is the case with many things in the world right now, as mortgage professionals, we are now facing questions about the length of time someone could have a mortgage based on the news cycle out of the US. If you missed it, there is currently an idea that is being floated politically in the United States, where the idea is that they could make longer mortgage amortization periods available to their citizens. The reasoning behind this is that a longer amortization makes your monthly payments lower, and in turn, this makes more cash flow available to homeowners every month to offset the rising cost of living that we are currently facing. This leads to the question: Would a longer amortization period be good for homeowners? Also, what are the risks associated with this type of mortgage? Let’s take a look at the way that the mortgage industry works in Canada and reflect on how longer mortgage amortizations would work here.

In This Article

- A Recent History Lesson

- Why Amortization Matters

- Other Ways That Amortization Matters

- The Canadian Perspective

- Who Can You Talk To?

A Recent History Lesson

Most Canadians automatically think of a 25-year time horizon when they think of a mortgage. This was traditionally the case, but you may or may not remember that there was a time period recently when longer amortizations were available in Canada. In 2006, the decision was made to allow insured mortgages in Canada to have up to 40-year amortizations. An insured mortgage in Canada is a mortgage where the borrower has less than 20% as a down payment for the property, so the loan must be insured by someone like the CMHC. This was done in an effort to make monthly payments more affordable and allow more people to qualify as homebuyers. This option didn’t stay available for too long, though. With the 2008 housing crisis in the US and the way that the housing bubble devastated the world economically, the decision was quickly made to begin to pull back on the mortgage rules in Canada, adding back in the restrictions that had been in place for so many years prior to 2006. The end result was that by June of 2012, the maximum amortization for an insured Canadian mortgage was back to 25 years. The biggest reason for extending the amortization period was the fact that lower monthly payments allowed more people to meet the qualifications for a mortgage, but the risks associated with the longer term outweighed this advantage. Particularly, if we entered into a period of time when home prices fell, or interest rates rapidly increased so the long amortization experiment in Canada ended very quickly after it was introduced.

Why Amortization Matters

When you look at mortgage amortization and try to figure out why it matters and why offering longer amortization periods would matter, what you see is that the biggest ‘advantage’ of having longer amortizations is that the longer your amortization is, the lower your monthly payment requirement is. This helps more people with the qualification for a mortgage because a lower payment allows more people to fit into the affordability calculations. But there are other things that you need to consider. The longer the amortization period you have, the longer it’s going to take to pay off your house. If we look at a comparison of a 25-year amortization and a 50-year amortization with a loan of $500,000 and an interest rate of 5% this is what you see:

| Amortization | Monthly Payment | Total Paid Over Full Amortization | Total Interest Paid |

| 25 years | $2,908 | $872,409 | $372,409 |

| 50 years | $2,252 | $1,351,578 | $851,578 |

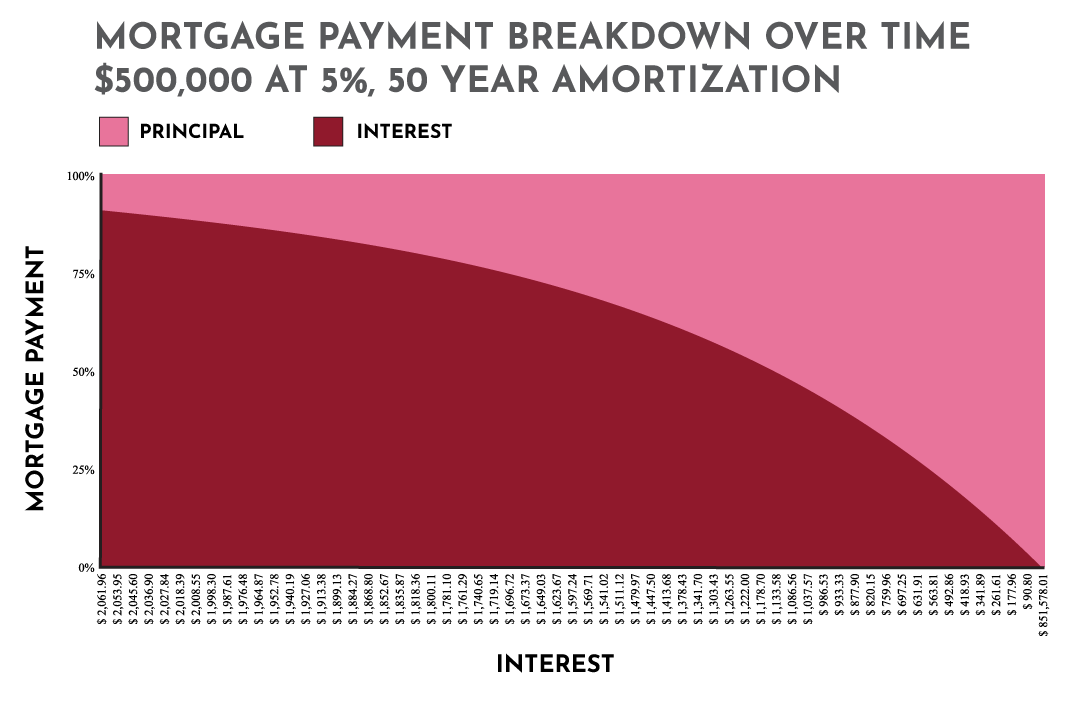

So, while yes, the monthly payment is lower, what you can see is that the total cost of borrowing is $479,169 more when you take the longer amortization period. This is what it costs you to make it so that your monthly payment amount is $656 lower each month. How is this possible? You need to remember how mortgage interest works. When you make your monthly payment early in the contract, the majority of that amount pays interest costs, with only a small amount being applied to the principal of the loan. As time passes, the amount of interest for each payment is reduced because of the small reductions in principal. If we look at how the payment breaks down for the 50-year amortization schedule, it looks like this:

This clearly shows that the interest portion dominates the amount of your monthly payments early on in the loan. It takes decades for the interest and principal payments to balance out, and then, only in the last 10-15 years of the plan does the principal repayment happen at any reasonable pace. This all comes down to the way that mortgage interest is calculated and applied to your loan. This is why making accelerated bi-weekly payments, where the equivalent of one monthly payment each year goes directly onto the principal is a great strategy. This seemingly small amount can cut 3.5 years off of how long it takes you to pay off your mortgage and save you around $61,000 in interest on a 25-year mortgage of $500,000. Simply because your ‘extra’ annual payment reduces the principal amount directly. Lower principal balances mean lower amounts of compound interest and large savings to the homeowner.

Other Ways That Amortization Matters

Other than simply looking at the interest cost and how taking a longer amortization period can cost you huge amounts in higher interest costs over the length of your mortgage, there are other ways that a longer amortization period can affect you. These include things like:

- How Fast You Build Equity in Your Home: With a longer amortization period, the time it takes to pay down the principal on the loan is longer and slower. This means that you are also building home equity at a slower rate. This matters if you want to try and refinance your home to make renovations or access home equity for any reason.

- The Stability and Risk of your Loan are Affected: If you take a longer amortization, the reality is that you have chosen to remain more heavily in debt for a longer period of time. This means that you have less stability and are more susceptible to things like decreases in the value of real estate or changes in interest rates than someone who has chosen a shorter amortization length.

- You Need to Build Mortgage Payments in Retirement into Your Financial Plan: For many generations, a major financial goal was to have the mortgage paid off prior to retirement. While this remains a goal for many people today, the reality is that it has become increasingly less achievable as home values have increased because the mortgages that go with those increases have gotten larger as well. And if you chose to take out a 50-year mortgage, it is highly unlikely that you would be able to enter retirement without needing to have a plan in place to make a monthly mortgage payment.

The Canadian Perspective

There are a few different ways that Canadian mortgages differ from their US counterparts, but one in particular is that, under certain conditions, the interest that is paid on a mortgage in the United States can be tax-deductible, even on someone’s primary residence. In Canada, this isn’t the case. This is an important distinction because, without interest being tax-deductible, Canadian homeowners have much more incentive to pay off their mortgage. With the ability to deduct the interest that they pay on their mortgages, the incentive to pay off their mortgage is less for Americans. This matters in our discussion because when we look at longer amortizations, we have seen that they come with higher interest costs. Since that interest is tax-deductible, the longer amortization in the U.S. may be more attractive than it would be to Canadians who don’t get the tax efficiency that they do with regard to the interest that they are paying south of the border on their mortgages.

Who Can You Talk To?

When it comes to cutting through all of the noise and getting right down to finding out what the best mortgage is for you, make sure that you reach out to a mortgage broker to help you. As is often the case, I highlight to readers here, I said call a mortgage broker, not your mortgage specialist at the bank. A mortgage broker works for you to shop through many different lenders, ensuring that you land in the best product for your unique situation. The bank’s mortgage specialist can only place you into one of the limited products that they offer, and is often compensated based on how high an interest rate they can sell you on. There is a long list of reasons why a mortgage broker is a better choice than a bank, but suffice it to say, you need a partner in your corner, not an employee of the lender who is working for them, not you. Now that the aside is over, reach out to the team at Strata Mortgages if you need help from a broker and don’t know where to start. Their team of experts can help you navigate your way through the mortgage process and make sure that you understand everything that goes into your mortgage, and ensure that wherever you land is the best solution for you.